Measure AM Value, Not AM Printers

Featured in 3DPrint.com

In our previous article, “RIP 3D Printing. Long Live AM!” we suggested that the paradigm was shifting. It is moving away from the printer OEM being the center of the AM universe towards the part manufacturer using AM to produce products. Recent conversations have led us to double-down on that premise, with reinforcement from data-driven analysis to convey the message that AM is ready to be measured by the same metric the rest of manufacturing is – parts and services.

Our opinion is unchanged that AM is a manufacturing tool, yet the whispers of its premature demise persist. Things are good among the companies using AM to make parts and products or selling their AM services to help companies make parts. New printers are part of the solution space where companies seek to improve their return on invested capital (ROIC). Maximizing the output of their existing AM printer fleet is an easier decision.

Global manufacturing is measured by the total value of goods and services. It is not measured solely by how many machines were sold in a given year or projected to be sold in future years. AM is growing in nearly all aspects (machines, materials, services).

The metric of printer units delivered is no longer linear with value. We say it’s time to redefine the metric. The basic premise of the book “Freakonomics” is that you get what you reward. Whether you intended to reward an outcome or behavior is a separate thought, but the result achieved was motivated by how it was measured.

AM > Printers

All businesses, for-profit ones anyway, are rewarded by profit. It’s how they have money to pay for more R&D, enhance their products, improve, and upskill their employees.

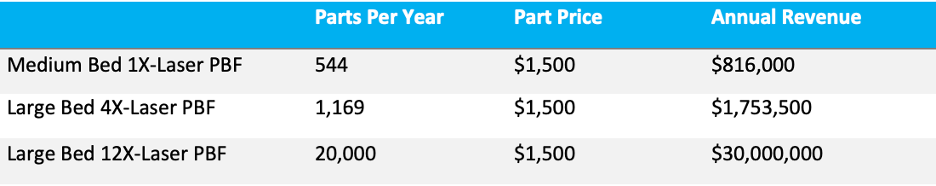

Traditionally, analysts have considered printer sales the only measure of the AM market. The stock price is occasionally used as a barometer. The AM industry, however, comprises a diverse set of materials and services and countless makes and models of printers that add value in different ways. By measuring units sold under the current situation, a 12-laser large PBF printer counts the same as a single-laser small PBF printer; however, the revenue generated from each is quite different.

Figure 1 shows the value chain for AM, further evidence that the printer is an enabler, but small compared to what it takes to make and deliver parts.

The bottom line: AM is more than printer sales. Let’s examine value creation by printer type, which reveals the growth of materials and services.

Figure 1: Value Chain for Additive Manufacturing

Size Matters…As Does Throughput

In the TBGA Think Tank, we rolled up our sleeves years ago to help a company understand how they could make money in AM by making and selling parts to other companies. We found it hard to make money with one “medium-sized, single laser printer. Its productivity is low; it makes a few parts at a high cost, so the commensurate value of the part has to be significant.

In our “Multi-Laser” series, we demonstrated how employing more lasers can improve productivity. Figure 2 shows the relative cost to produce the same finished part with three different systems, keeping the settings similar for comparative purposes. It also illustrates that the cost of making a part is more than the printer and, with productivity gains, it becomes less and less.

Figure 2: Cost comparison of single and multi-laser PBF systems for the TBGA Control Arm part

With productivity comes profitability, but there is a catch: You must have the volume and operations to support it. If the operations don’t adjust, productivity is not realized, and ROIC and profitability suffer. In the table below, we relate the volume of parts that can be made alongside a representative part price. With volume comes revenue growth as the large system can generate $30M annually compared to <$1M for the medium system (price held constant for simplicity). With more parts comes growth in material feedstock and services like heat treatment, machining, inspection, and the like to meet the part drawing requirements.

Table 1: Productivity Gains Matched with Increased Operational Tempo Yields Revenue Growth

Rather than only tracking the number of printers sold as the metric of health for the AM industry, we suggest emphasizing part production, and in doing so, it will become apparent that the printer is an enabler while the materials and services are where the majority of the revenue is earned. Further to that point, whilst our example highlighted the value differences within the same family of AM technology, we would point out that there are still larger AM systems like Cold Spray, Friction Stir, and the family of Directed Energy Deposition processes that output more material in larger parts than is practical with PBF. For example, Cold Spray can output 1-5 kg/hr (of aluminum), which consumes more powder and makes much larger, therefore, higher value parts that also require heat treatment, machining, surface finishing, inspection, etc. The printer is much like the tip of the iceberg, highly visible, but the volume is below the water line.

Growing a Layer at a Time

Global manufacturing is a $1.09 trillion industry (Statista). Additive Manufacturing Research puts the AM industry value at $14.7 billion, but let’s say we’re shy of 2% of the overall manufacturing industry. Global manufacturing is expected to grow by 1% per year this decade (Statista), whereas the growth of AM is ~20% (consensus estimate from various sources).

We’re at a moment when some companies have figured “it” out, and they aren’t likely to tell you about it because they have spent a lot of time and money getting there. They are making parts. They are consuming material. AM is becoming boring, but that is good.

As noted in the earlier article, what drove printer sales initially differs from today. That situation created a latent capacity of printers, and as the part count grows, that latency is consumed. New printers require additional capital, and money is more expensive today than in the past. Manufacturers of parts will squeeze as much as they can out of the assets they already own. Numerous software companies today help machine shops optimize operations because “if you ain’t making chips, you ain’t making money.” Similarly, with AM, you still make chips; they are just higher-value chips. Today, companies need to make money with the printers on hand—not buy more printers.

What Can Be Measured Can Be Improved

Let’s be clear: the AM industry is growing. The emphasis from here will be on part production and the services supporting part production. If your metric doesn’t align with this, you have the wrong metric, not the wrong industry. Long live AM!